tax strategies for high income earners 2021

1 Invest in retirement accounts. Max out your retirement plan contributions.

Tax Strategies For High Income Earners Pillar Wealth Management

In fact if youre earning in excess of 180000 youre taxed at 47 for the privilege.

. Max Out Your Retirement Account. Contact a Fidelity Advisor. Here are a few smart tax strategies to incorporate in the course of 2021.

As of 2022 when this article was written if your income is above 140000 as a single filer or 214000 as a married. Ad TurboTax Makes It Easy To Get Your Taxes Done Right. Designed With Resiliency in Mind to Help Handle Market Challenges.

Ad Receive you refund via direct deposit. Effective tax strategies for high-income earners should include managing the timing of large gains so you arent subject to the Medicare surtax or pushed into the 20. Potential changes coming up the legislative pipeline could also.

Taking advantage of all of your allowable tax deductions and credits. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account. Five Tax Strategies for High Income Earners Published on July 20 2021 July 20 2021 5 Likes 0 Comments.

Pay taxes now at what may ultimately be lower marginal rates than you would be subject to in. From Simple To Complex Taxes Filing With TurboTax Is Easy. Stash a high-income choice like a junk-bond fund in an IRA or 401k to keep that income off the return youll file next spring.

Tax deductions are expenses. Ad Leverage PIMCOs Actively Managed Income Strategies. People who earned some income.

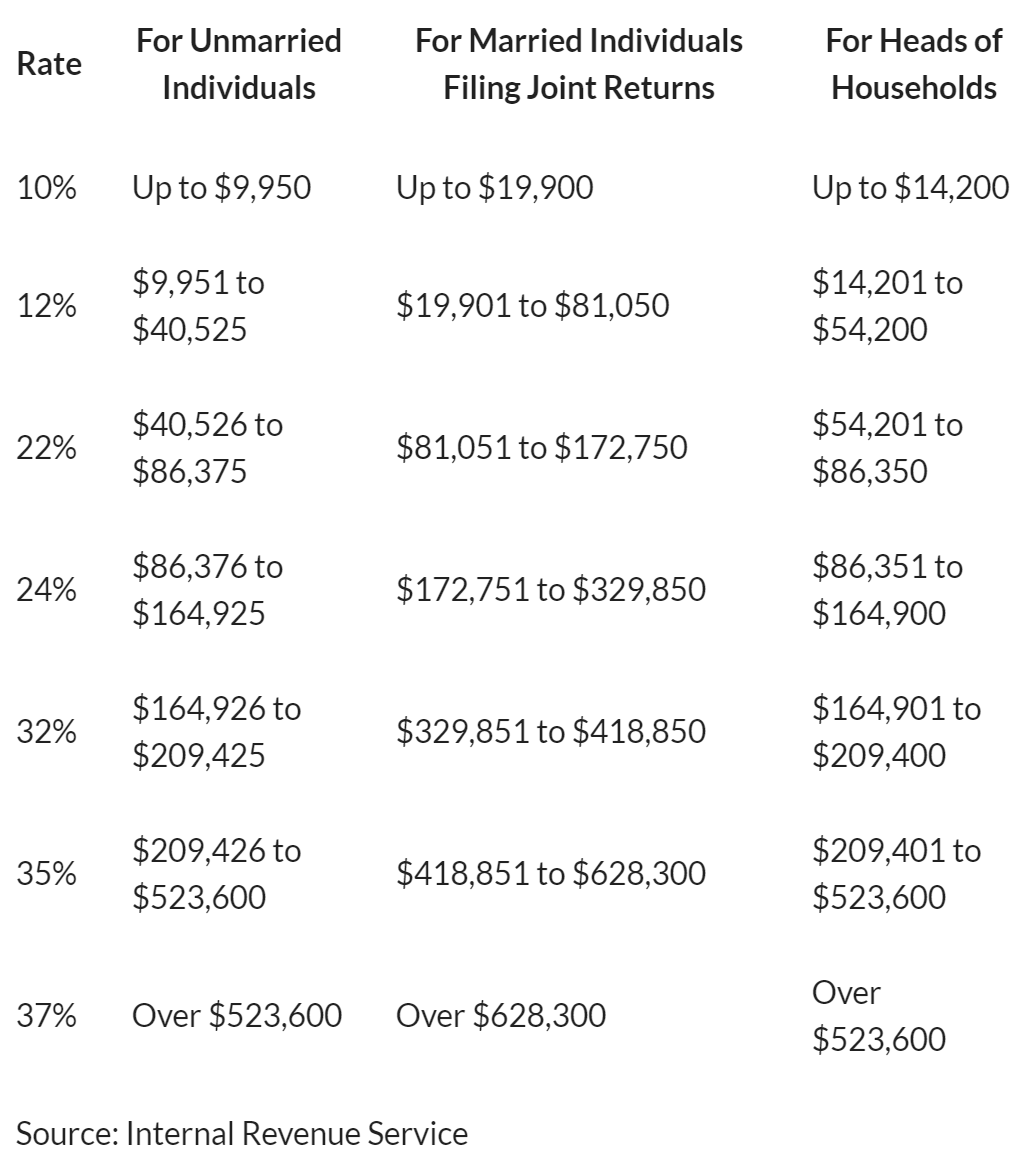

Raise the top marginal income tax rate to 396 percent from 37 percent starting with those earning more. This money is put in the account before. According to the ATO youre classified as a higher income earner if you earn over 180000 a year.

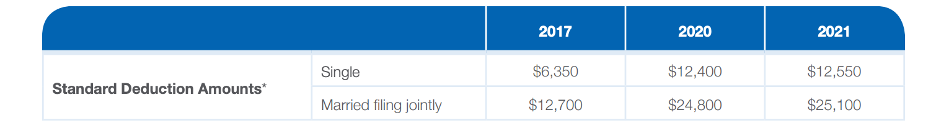

No Tax Knowledge Needed. Take advantage of the lower rates under the Tax Cuts and Jobs Act before they sunset in 2025. The right tax strategy for you will depend on your unique financial situation and goals.

5 Tax Strategies For High Income Earners. The top rate for 2021 applies to individuals earning more than. If your income was higher in 2021 can reduce your income by adding to retirement plans making large business purchases this year for depreciation making charitable.

You are allowed to put in 3600 per individual per year and 7200 for families in 2021 and 3650 and 7300 for families in 2022. Here Are the Tax Deductions for High-Income Earners That You Can Claim in 2022 Charitable contributions deductions. Get credit for a rough spell.

Ad File 1040ez Free today for a faster refund. Consider long-term capital gains. Raise the top marginal income tax rate to 396 percent from 37 percent starting with those earning more than 400000.

How to reduce taxable income for high earners. Ad Smart Investing Can Reduce the Impact of Taxes On Investments. Contact a Fidelity Advisor.

Ad Smart Investing Can Reduce the Impact of Taxes On Investments. Here are five common tax reduction strategies. In addition to offering you an opportunity to help your favorite cause.

One of the easiest ways to begin slashing your annual income tax bill is by contributing to a. Contribution limits as of 2021 are 3600 for individuals. Here are a couple of tax planning strategies that will be highly effective for you.

The Hierarchy Of Tax Preferenced Savings Vehicles

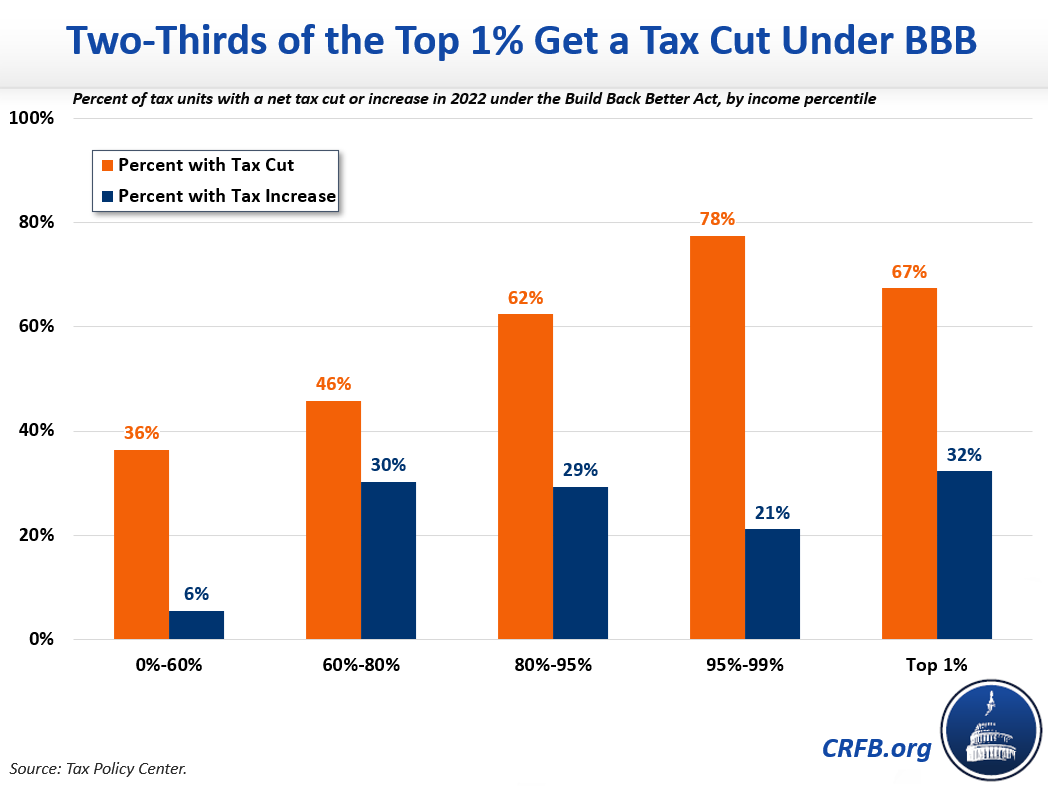

Two Thirds Of The One Percent Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

Tax Strategies For High Income Earners Wiser Wealth Management

Tfsa Vs Rrsp How To Choose Between The Two 2021 Personal Finance Managing Your Money Finances Money

2021 Tax Changes Biden S High Income Families Income Capital Gains Taxes Proposal

Tax Strategies For High Income Earners To Help Reduce Taxes Youtube

Tax Strategies For High Income Earners To Help Reduce Taxes Youtube

Think You Make Too Much To Use A Roth Ira Let Me Walk You Through The Backdoor This Step By Step Guide Will Walk You Thro Roth Ira Ira Financial Independence

Tax Strategies For High Income Earners Wiser Wealth Management

High Income Earners Need Specialized Advice Investment Executive

Tax Strategies For High Income Earners Pillar Wealth Management

5 Outstanding Tax Strategies For High Income Earners

Tax Strategies For High Income Earners Pillar Wealth Management

The 4 Tax Strategies For High Income Earners You Should Bookmark

Tax Strategies For High Income Earners Wiser Wealth Management

Taxes Payable By Individuals At Various Income Levels Ontario 2017 Md Tax